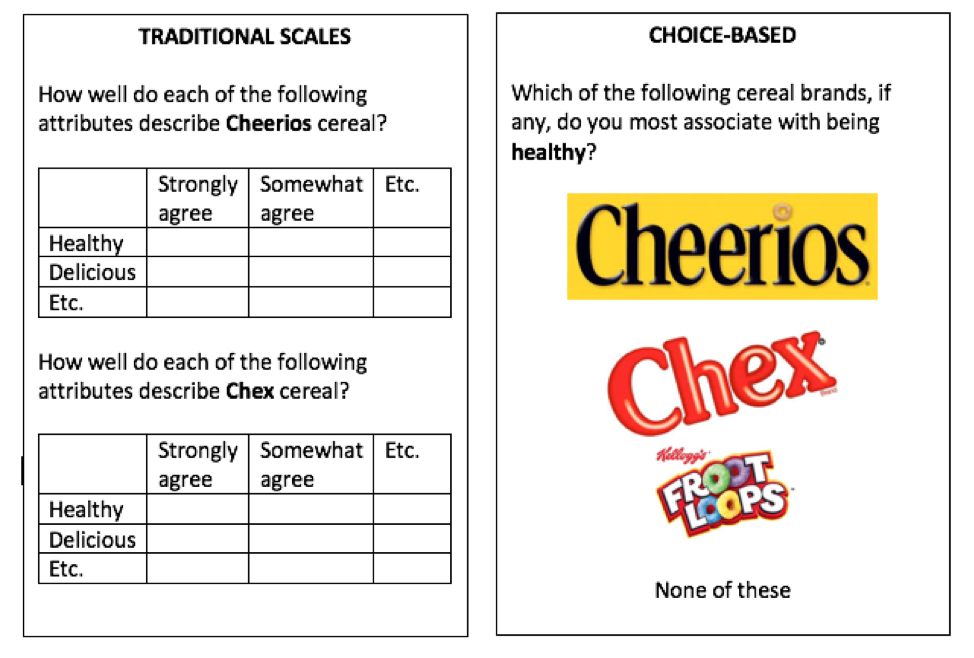

An overriding theme in market research innovation is getting closer to the way people actually think, feel, and behave. We’re seeing more techniques and approaches that allow us to observe and measure versus ask. The body of evidence for this shift is extremely compelling, especially when combined with the latest cognitive and behavioral science advances. One way to do this within a quantitative research context, is to focus on respondent choice as a measure, versus traditional scale-based responses. At a recent market research industry conference, Dave Santee of True North Market Insights gave three compelling arguments against traditional Likert scales, saying: they are not comparative or in context, respondents dislike them and don’t make decisions that way, and different groups/cultures use scales differently. Multiple expert sources agree that research approaches that ask respondents to make a selection from a relevant choice set are more predictive than research designs that ask respondents to rate or score those same options on a scale. We know that our brains love shortcuts—we operate in deselection mode when shopping, not rating each and every product before arriving at a decision. By the way, this approach also gets around the dreaded matrix question! Here is a simple example that works within a traditional survey framework (truncated just to make the point): There are trade-offs. If you’re used to getting a rating for every attribute for every brand, that won’t happen in this type of research design. But if the findings more accurately reflect the way that people feel and act, that seems like a good trade-off to make. The benefits will go to those who can convince their organization to throw away the old scorecards, dashboards, and databases. As an ex-corporate researcher, I understand that’s no easy feat!

In addition to restructuring questions for choice (versus scales) within a traditional survey framework, there are other, entirely choice-centric research methodologies, including MaxDiff, Conjoint, Prediction Markets, and Virtual Shelf/Store research. These rely exclusively on respondent choice for data collection (but can also be supplemented by direct questions within the broader study). Virtual shelf tests are something I’ve personally been doing a lot more of recently. They are my preferred way of doing packaging testing, but I’ve also used them for planogram/shelf set design and even new product qualification (in lieu of a traditional concept test). Instead of asking purchase intent or other scale-response questions, respondents simply shop for their desired product(s) from a category shelf set, generating product/package selection and spending metrics. This type of testing doesn’t have to be restricted to “shelves” if that’s not relevant for your category or brand. The key principle is to put the product (or service) in the context that consumers will actually evaluate and make the purchase decision. Other examples might include: mocked-up Amazon.com pages of products, restaurant menus, or website lists of services (don’t forget to include prices!). - I have very classical CPG market research background, so I cut my teeth on survey scales and grids and live for the thrill of a top quintile purchase intent score, but I also love learning about new methodologies and techniques that get us closer to predicting actual consumer behavior in a complex reality. Choice-based research techniques can not only help us better reflect and predict reality, but they also have the benefits of being more engaging for respondents and more mobile-friendly, both of which lead to higher survey completion rates, more representative sample, and ultimately, better quality and more accurate data.

1 Comment

2/15/2023 08:43:43 pm

Research into consumer behaviors like this is fascinating to me because there is so much we can learn about people by how they shop. Retail stores try their best to implement successful planograms to display products people will buy. I guess more knowledge is needed to better connect these two fields of market research.

Reply

Leave a Reply. |

AuthorSarah Faulkner, Owner Faulkner Insights Archives

July 2021

Categories

All

|

RSS Feed

RSS Feed